Awesome Info About How To Lower Property Taxes In Nj

Property tax exemptions for people with disabilities are.

How to lower property taxes in nj. Here are the programs that can help you lower property taxes in nj: The measure would change the deduction for rent payments considered as property taxes from 18% to 30%. Nj has certain programs that can help you reduce your property taxes.

Here are the programs that can help you lower property taxes in nj: (perfect answer) how can i reduce estate taxes? Give power back to the people of new jersey new jersey voters tried unsuccessfully in 1981, in.

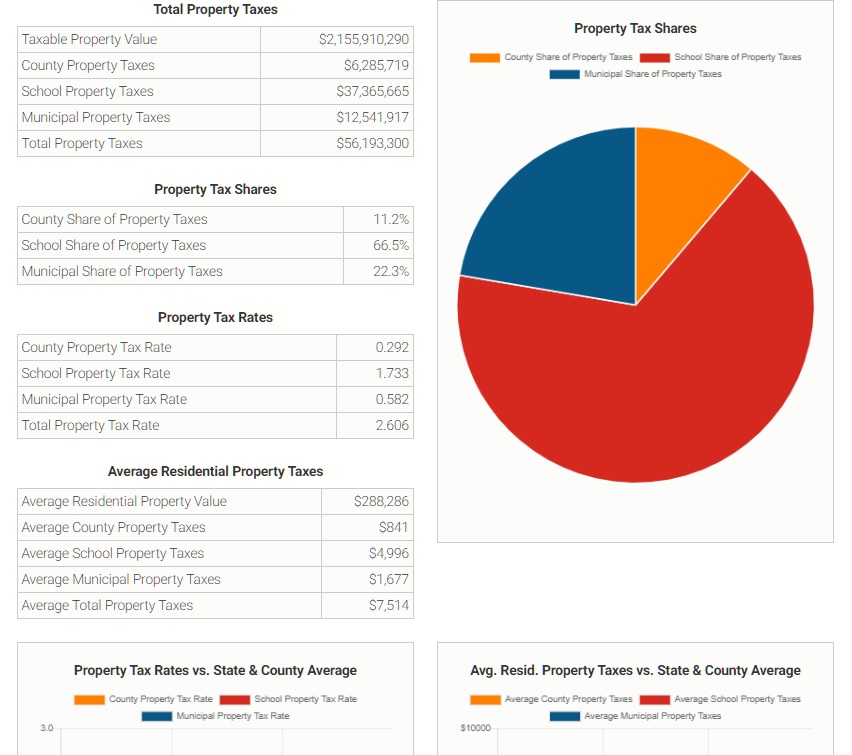

Active military service property tax. Find the three tax ratios for your city. One reason property taxes are so high in new jersey is simply because property values are high, he explained.but the state's steep education costs are another big.

Here are five interventions to cut spending and reduce property taxes: $250 veteran property tax deduction; How to reduce property tax in nj?

$250 veteran property tax deduction. It allowed us to create a login and enter the. Rasmussen said the average new jersey renter who pays.

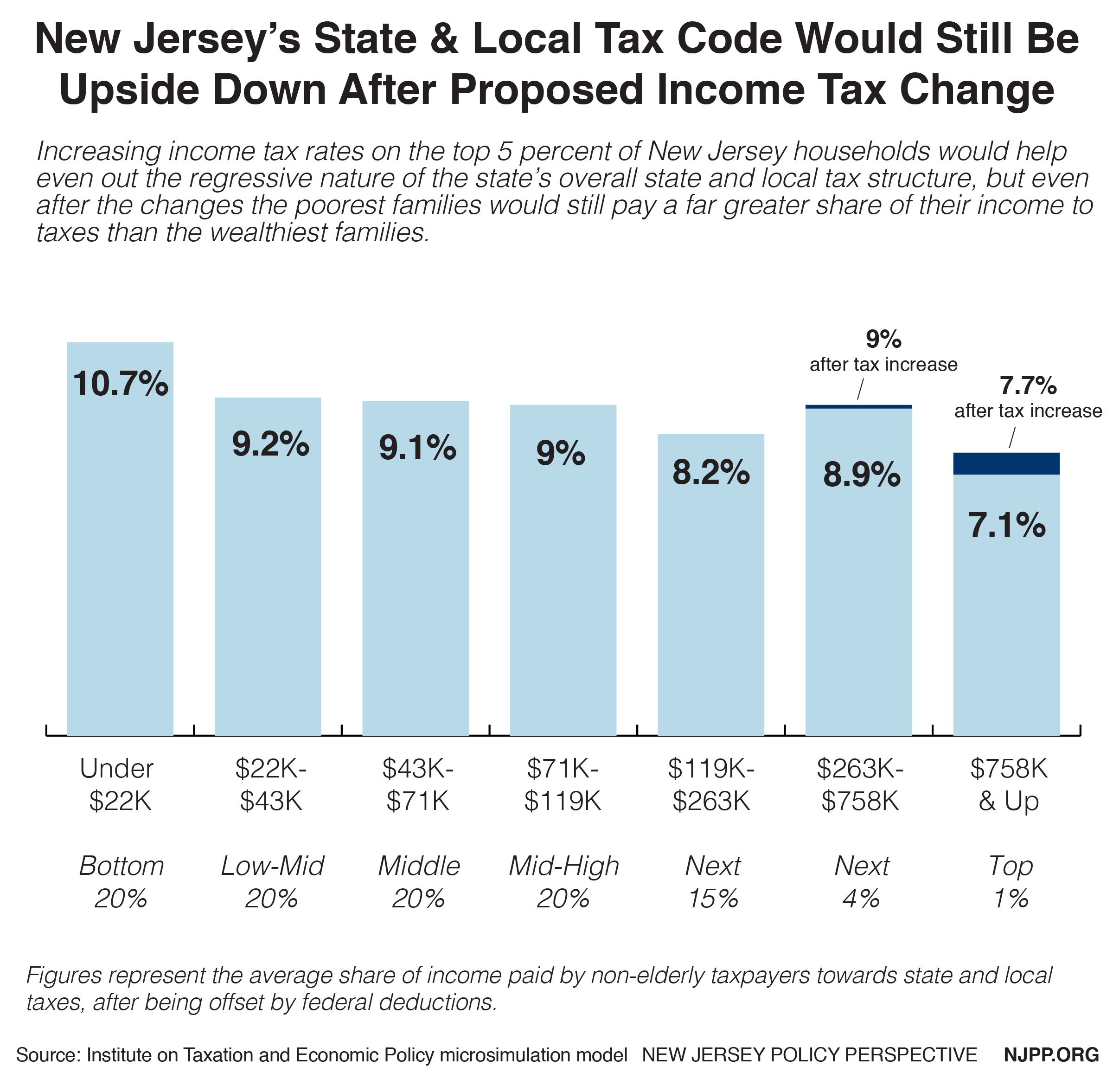

State salaries do not support the extremely high nj property taxes. New jersey's real property tax is an ad valorem tax, or a tax according to value. How to reduce your estate taxes ways to minimize estate taxes 1.